Date Posted: 02-Dec-2024

Author: Sarbhanu Nath, Bangalore Urmila Narzary, Bangalore F Xavier Casals, Croydon Nebin Mahesh, Bangalore

Key points

- This report assesses the likely risks resulting from the conflict between China and the Philippines in the South China Sea over the next six to 12 months. As the South China Sea is a major global trade route, an escalation of tensions between the two countries can potentially disrupt trade and supply chains, affecting countries beyond the region

- The report examines three scenarios involving China and the Philippines that could play out in the region – first, where tensions continue at the current level; second, where the dispute expands in scope but does not result in war; and third, an outbreak of war. Janes assesses the overall risk score of each scenario by combining its probability with the impact of each scenario on three factors of the dispute (impact factors) – the geographical area affected by the dispute, the level of militarisation of the assets deployed by each side, and the intensity of confrontation between the parties

- Janes assesses that tensions between China and the Philippines over disputed territories in the South China Sea are very likely to continue over the next six to 12 months, and this scenario presents the highest overall risk. The likelihood of confrontation leading to war between China and the Philippines is assessed to be very unlikely but is the scenario with the greatest impact

Introduction

The South China Sea is an important trade route that connects the Pacific and Indian Ocean regions. According to the US Energy Information Administration (EIA), in 2023 76 million barrels per day (bpd) of petroleum products were traded globally via maritime transport, with approximately 28 million bpd (37%) of those shipments passing through the South China Sea. The strategic importance of the South China Sea has almost certainly intensified maritime territorial disputes between various countries in the region that seek to strengthen their historical claims to geographical features. An escalation of tensions in the region has the potential to disrupt trade through this global waterway, which would very likely result in supply chains being affected worldwide.

The sea is also rich in resources and has a high potential of being a source of hydrocarbons, especially natural gas. The EIA estimated in March 2024 that the Spratly Islands region to have deposits of up to 3 billion barrels of petroleum and other liquids and up to 16.2 trillion cubic feet of natural gas in undiscovered resources. The EIA noted that in 2023 China produced 410,000 bpd of petroleum liquids and 489 billion cubic feet of natural gas from its deposits in the South China Sea, making the disputed regions a potentially valuable energy source for whoever controls it.

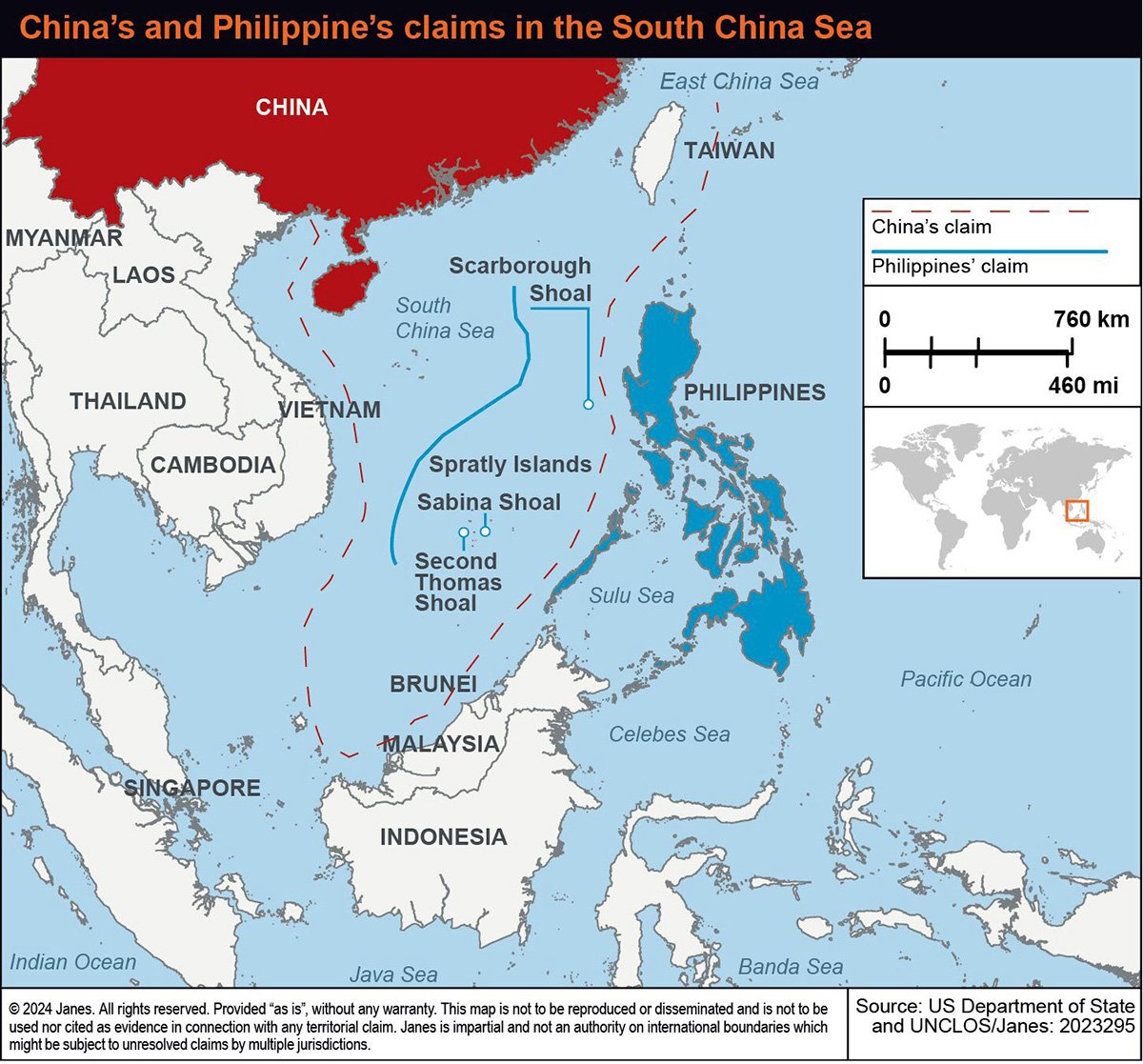

Since February 2023 tensions have been highest between China, which claims almost the entirety of the South China Sea, and the Philippines, which claims Scarborough Shoal and the Spratly Islands as part of the ‘West Philippine Sea' covering the Philippines' exclusive economic zone (EEZ). Although the Permanent Court of Arbitration in The Hague ruled in favour of the Philippines' territorial claim in 2016 and stated that Beijing's claims have no basis under international law, China rejected the ruling and, as of November 2024, continues to maintain its claims over the area.

On 17 June 2024 a Philippines rotation and reprovisioning (RORE) mission to the disputed Second Thomas Shoal area in the Spratly Islands was intercepted by the China Coast Guard (CCG) and Hainan maritime militia. During the incident, Chinese vessels blocked the Philippine convoy and rammed some vessels, wounding at least eight Filipino sailors. This marked a very serious escalation in the dispute between the two countries.

China's and Philippine's claims in the South China Sea. (US Department of State and UNCLOS)

China's and Philippine's claims in the South China Sea. (US Department of State and UNCLOS)

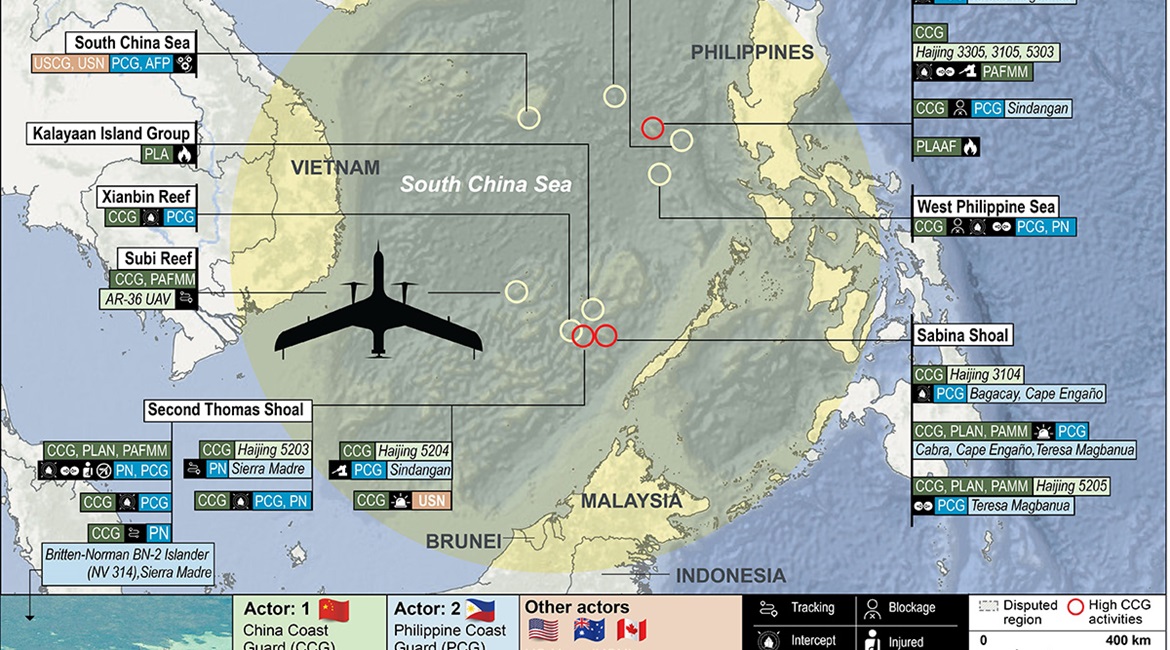

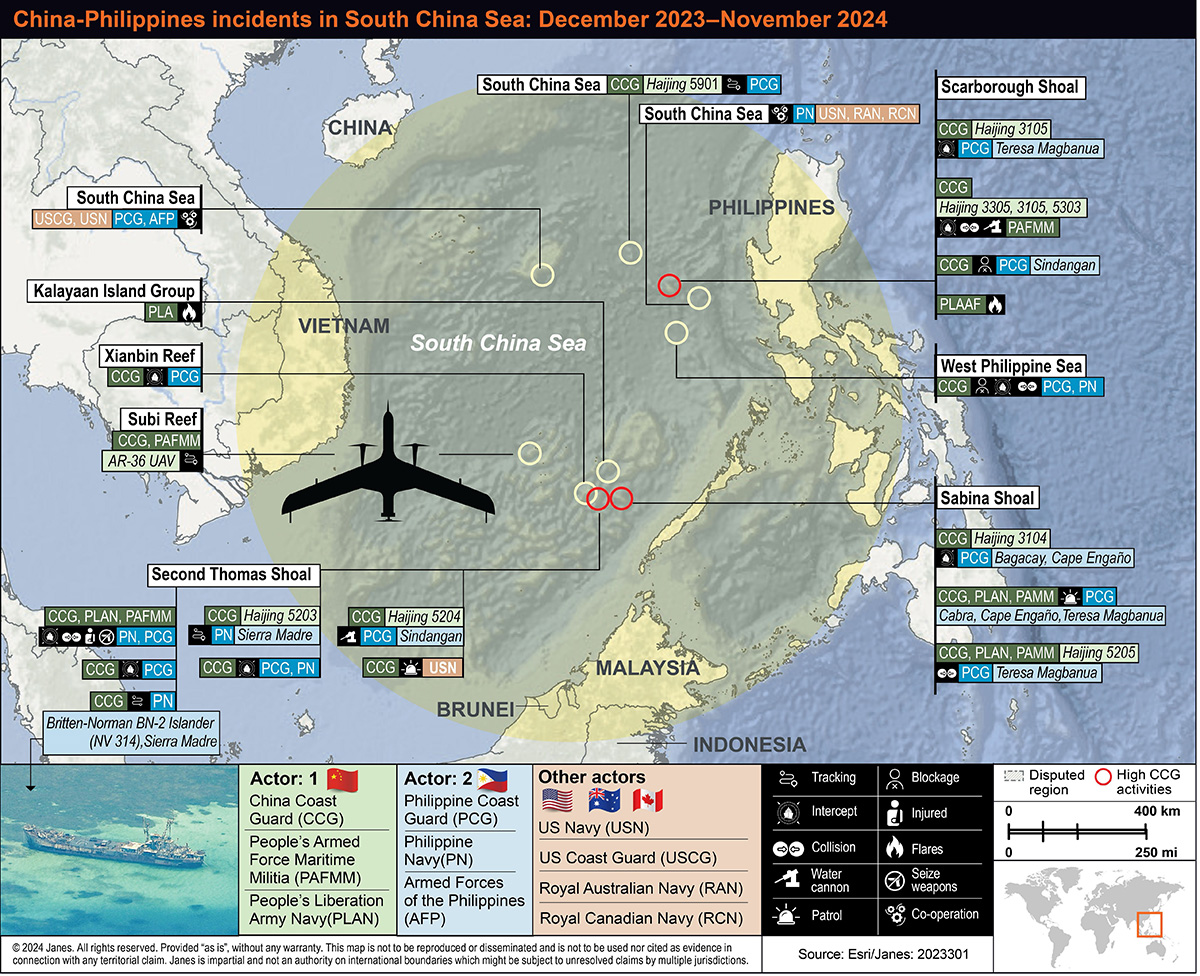

China-Philippines incidents in the South China Sea: December 2023–November 2024. (Esri/Janes)

This report assesses the risk (impact and likelihood) associated with three scenarios to address the following intelligence requirement:

How will the security situation relating to territorial disputes between China and the Philippines in the South China Sea evolve over the next six to 12 months?

Scenario 1

Continuation – Tensions continue at the same level, but China and the Philippines make efforts to prevent escalation

Scenario 2

Escalation – Confrontational incidents increase between China and the Philippines, leading to war

Scenario 3

Expansion – China expands the dispute by increasing pressure around other disputed areas

Janes analysts have identified three factors against which the impact of each scenario will be assessed (impact factors):

- Geographical scope: The size of the area in which the armed confrontation occurs should the scenario materialise.

- Militarisation level: The extent to which the countries involved in armed confrontations deploy their military units and assets should the scenario materialise.

- Engagement intensity: The number of casualties and extent of damage to assets recorded per confrontation incident should the scenario materialise.

Scenario 1: Continuation – Tensions continue at the same level, but China and the Philippines make efforts to prevent escalation

Tensions continue between China and the Philippines over disputed territories, with occasional armed confrontations. China continues to adopt assertive tactics against the Philippines, but both governments engage in dialogue and establish risk reduction mechanisms to prevent military escalation.

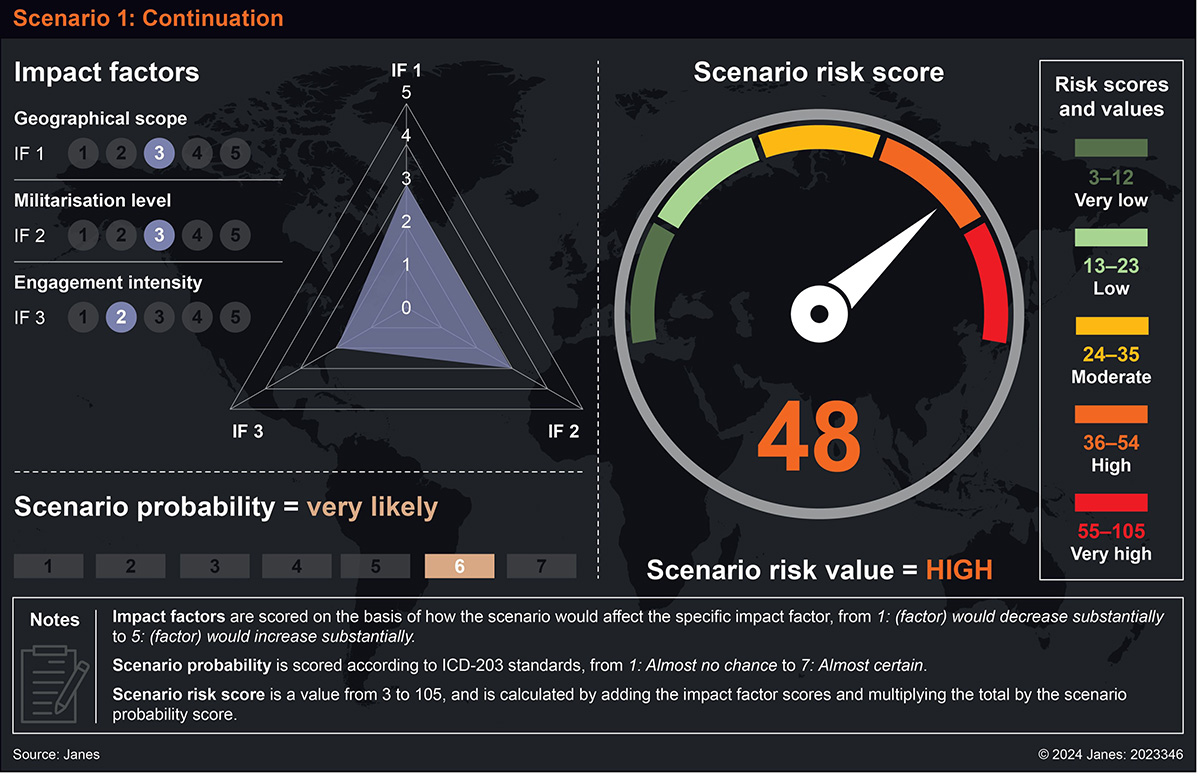

Scenario 1: Continuation – Tensions continue, but China and Philippines make efforts to prevent escalation. (Janes)

Scenario 1: Continuation – Tensions continue, but China and Philippines make efforts to prevent escalation. (Janes)

Probability assessment

Janes assesses this scenario to have a probability score of 6 (very likely). This is based on the following three factors:

1. A major escalation in the dispute would very likely be against China's strategic interests

China would very likely seek to avoid a situation involving extra-regional powers such as the United States in the region. An escalation to military conflict would almost certainly prompt the Philippines to trigger Article IV of the 1951 US-Philippines Mutual Defense Treaty (MDT), allowing the US to deploy its military to support Manila. On 31 May 2024 Philippine President Ferdinand Marcos Jr stated that deaths of Filipino troops or civilians would be “very close” to an act of war and that the US held the “same standard” for such situations. In May 2023 the Philippines and the US established the Bilateral Defense Guidelines, in which the US reaffirmed that an armed attack on the Philippines, including anywhere in the South China Sea, would invoke Article IV of the MDT. Janes assesses that further incidents similar to 17 June, which could lead to the deaths of Filipino service personnel, are very likely to cause Manila to trigger Article IV.

War in the South China Sea would very likely disrupt trade flows, which would almost certainly negatively affect China's economic interests, including access to key resources. In a 21 March 2024 report, the EIA noted that in 2023 approximately 9 million bpd of crude oil and condensate were transported to China through this region.

It is very likely that if Chinese actions lead to armed conflict, then other countries like Vietnam, which also have territorial disputes with China, would offer some form of support, whether military or diplomatic, to the Philippines. On 30 August 2024 Vietnam and the Philippines agreed to deepen defence co-operation and collaboration on maritime security. Such forms of security co-operation will almost certainly hinder China's objective of asserting its claims in the region.

2. China is likely to prevent the Philippines from reinforcing Second Thomas Shoal

The leadership of the Communist Party of China (CPC) is almost certain to perceive a dispute over Second Thomas Shoal as a matter of when and not if, with the balance gradually tilting in China's favour as the BRP (Barko Republika Pilipinas) Sierra Madre deteriorates. The Philippines' claim is highly dependent on the BRP Sierra Madre, a vessel that the Philippine Navy deliberately grounded in 1999 to strengthen Manila's claim. However, the Sierra Madre is in a significant state of disrepair and is almost certain to break apart unless it is reinforced. The CPC will very likely prioritise preventing large shipments of construction materials to the vessel while engaging with the Philippines to manage tensions. This includes implementing the July 2024 “provisional agreement” between China and the Philippines regarding resupply missions to the Sierra Madre. Although neither China nor the Philippines published the details of the agreement, China almost certainly agreed to only allow the supply of humanitarian goods to the small detachment of Philippine personnel on the vessel. On 15 November 2024 the Philippine Navy completed its third resupply mission since the agreement was signed.

3. The Philippines almost certainly perceives a compromise as a concession of its sovereignty

The Philippines almost certainly sees the 2016 ruling from the Permanent Court of Arbitration in The Hague as legitimising its claims, and Janes assesses that there is almost no chance that Manila will accept a territorial compromise. The Philippines will almost certainly continue with resupply missions to its outposts in the disputed areas and allow fishermen to venture into contested waters to strengthen that claim.

Impact assessment

Geographical scope: 3 (would remain constant)

It is likely that China would intercept Philippine vessels near disputed features (24 n miles off the coast) to solidify its claim, but there is almost no chance that these actions take place farther from the disputed territories.

Tensions around the area of Second Thomas Shoal will likely de-escalate in the next six to 12 months if the provisional agreement between China and the Philippines remains in place. If China and the Philippines reach further agreements over other disputed territories such as Scarborough Shoal, it is likely that the geographical scope will reduce further.

Militarisation level: 3 (would remain constant)

China is likely to continue to primarily use CCG and militia vessels to enforce its territorial claims in the region and avoid escalation. CCG offshore patrol ships are mostly armed with water cannons, and Janes has observed mounted guns only on a select number of vessels. At the time of publication, CCG vessels have not opened fire against Philippine assets, limiting hostile actions to the use of water cannons, military-grade lasers to blind crew members, and ramming.

The Philippines is also likely to seek to manage tensions through diplomatic channels and not deploy heavily armed vessels in the region. Given the military imbalance between the Philippines and China, as well as the defensive nature of the 1951 MDT, it is very unlikely that the Philippines would seek to challenge China militarily in the disputed regions.

Engagement intensity: 2 (would decrease)

China and the Philippines are likely to avoid repeating incidents such as the clash on 17 June 2024 that led to Filipino personnel being wounded. Between 17 June and 1 November 2024 Janes Military Events recorded seven interception incidents between Chinese and Filipino vessels, but none of these encounters led to casualties on either side. However, there is a likely risk of major injuries to crew members involved in confrontational incidents, as China will very likely continue to use tactics such as ramming and the use of water cannons to block and deter Filipino ships in the disputed areas.

Key indicators of this scenario

High confidence (‘H'): China continues interception and harassment of Philippine naval and fishing vessels in disputed areas

Medium confidence (‘M'): The Philippines continues to encourage Filipino fishermen to sail into contested waters

M: The Philippines agrees to CCG inspections of its resupply missions to the BRP Sierra Madre

Low confidence (‘L'): The Philippines Coast Guard deploys more vessels to patrol the contested waters and provide protection to Filipino fishing ships

Key assumptions and information gaps

- A1: The US will deploy military assets in the region to support the Philippines if Article IV is triggered.

- A2: China will continue to assertively police disputed features, including Second Thomas Shoal.

- IG: The details of the provisional agreement between China and the Philippines are unknown, including the timeframe of the agreement. This makes assessing stability around Second Thomas Shoal more difficult. Without specific details of the agreement, Janes is unable to assess whether the agreement is likely to hold over the next six to 12 months.

Scenario 2: Escalation – Confrontational incidents increase between China and the Philippines, leading to war

Accidental escalation – comprising the unintended consequences of unintended events – following a clash between Chinese and Philippine assets leads to war, with the US joining after Manila invokes Article IV of the 1951 US-Philippines MDT. All actors deploy military assets to disputed features between China and the Philippines.

Scenario 2: Escalation – Confrontational incidents increase between China and the Philippines, leading to war. (Janes)

For more information, please see Scenarios South China security report