Hyundai Heavy Industries' (HHI's) proposed acquisition of rival South Korean shipbuilder Daewoo Shipbuilding & Marine Engineering Co (DSME) is facing further delays, stock exchange filings have said.

Korea Shipbuilding & Offshore Engineering (KSOE), the shipbuilding holding entity of the HHI Group, said on the Korean Exchange that the new deadline for the transaction is the end of September. The previous deadline – announced in January 2021 – was 30 June.

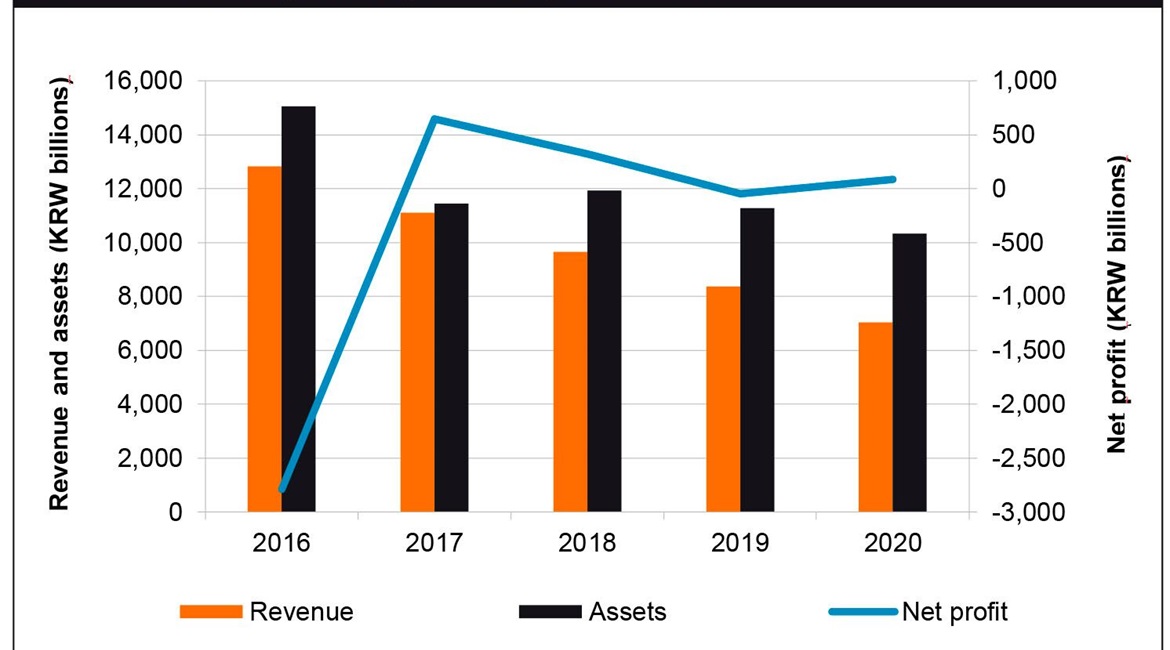

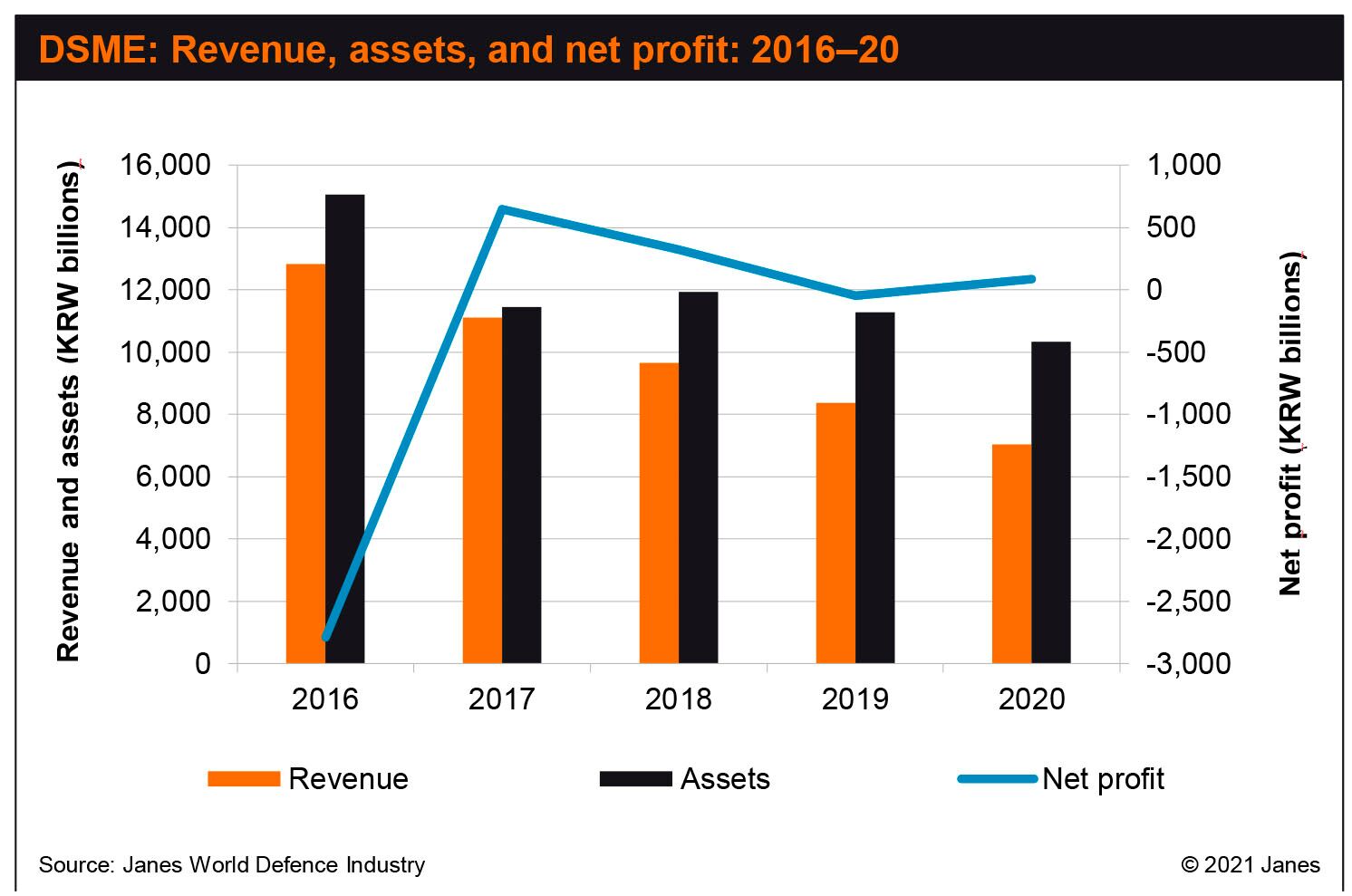

Between 2016 and 2020 DSME's annual revenues declined by 45% from KRW12.81 trillion to KRW7 trillion. (Janes World Defence Industry)

The announcement is the fourth time that the acquisition has been delayed since early 2019 when HHI reached an agreement on the deal with DSME's major shareholder and creditor, the state-run Korea Development Bank (KDB).

The new delay is linked to the requirement for foreign regulatory approvals for the transaction. Earlier this month, the European Union confirmed that the “clock had stopped” on its review of the takeover, with the delay likely linked to the EU's requests for additional information about the deal.

When announcing the acquisition in March 2019, HHI said the deal will require regulatory approval from states where the two corporations have prominent profiles.

China, Kazakhstan, and Singapore have approved the transaction but approvals from the EU, Japan, and South Korea are pending. The EU approval is regarded as crucial for supporting similar decisions in Japan and South Korea.

HHI's proposed acquisition of DSME will be worth about KRW2 trillion (USD1.8 billion), with HHI acquiring 59.7 million DSME shares at a price of nearly KRW35,000 each. The deal will give HHI a controlling 55.7% stake in DSME.

Looking to read the full article?

Gain unlimited access to Janes news and more...