European missile manufacturing consortium MBDA announced in its annual results that the firm’s order book had hit a record EUR17.4 billion (USD19.78 billion) following an absolute-terms increase of EUR600 million.

“This backlog is important as it provides us with important coverage and mid-term planning for us and provides us with confidence as management to continue with our planned investments in our capabilities and product development” Chief Financial Officer Peter Bols said.

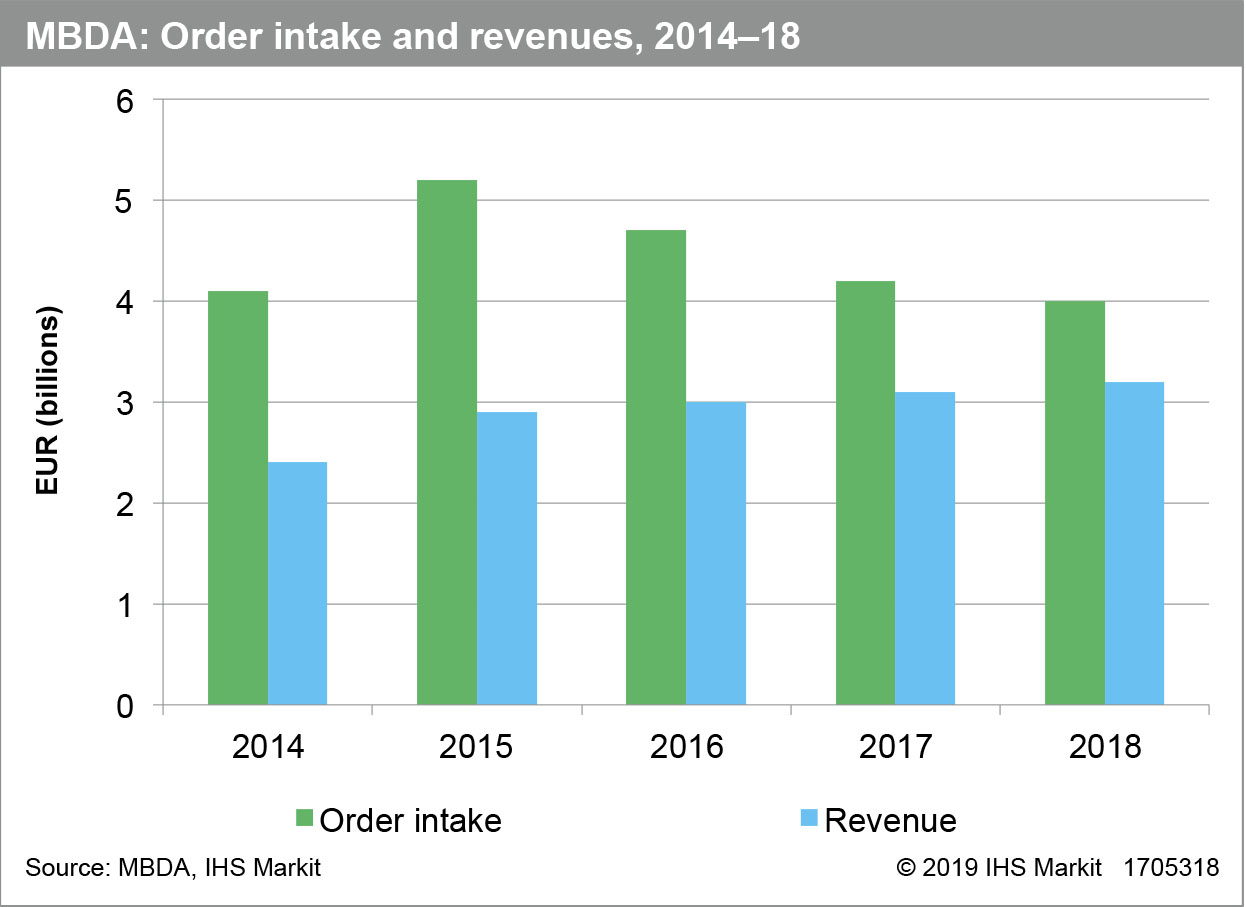

The news came as the company recorded orders of EUR4 billion in 2018, a slight decline on 2017’s EUR4.2 billion. According to Bols, the firm’s book-to-bill ratio remained above 1.0x, demonstrating ongoing demand for the company’s platforms and systems.

Despite a decline in order intake, MBDA's backlog hit a record high of EUR17.4 billion. (MBDA, IHS Markit)

There was a change in order intake sources for the company year on year, Bols said, with 2017 being primarily covered by export orders and 2018 by domestic orders in Europe. In addition to new system contracts, ongoing support and sustainment orders helped to support the company’s results, with Bols claiming that this was now a growth area for the business.

Export orders in 2018 totalled EUR1.5 billion, and included the weaponization of the Eurofighter Typhoon and NHIndustries NH-90 for Qatar, as well as exports of the Taurus air-launched cruise missile to South Korea.

This translated into export revenues in 2018 of EUR1.5 billion and EUR1.7 billion of domestic revenues, totalling EUR3.2 billion, remaining relatively stable year on year.

Looking ahead to 2019, the company expects a year-on-year increase in revenues but anticipates headwinds caused by export licensing restrictions, which are believed to be “sensibly” resolved in the medium- to long-term.

Looking to read the full article?

Gain unlimited access to Janes news and more...